stock option tax calculator ireland

When the option is exercisedgranted. This is when the employee sells.

Digital Tax Update Digital Services Taxes In Europe

Stock options restricted stock restricted stock units performance shares stock.

. You may save up to Rs 179400 more tax under Old Tax Regime from. Exercise incentive stock options without paying the alternative minimum tax. Assuming the 40 tax rate applies the tax on.

There are a number of issues with the current taxation of stock options. Stock option tax calculator ireland Sunday March 13 2022 Edit. How to calculate your rtso1 share option tax.

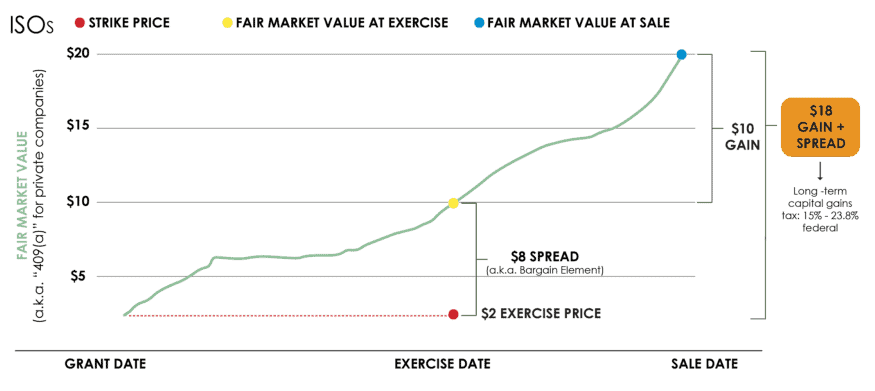

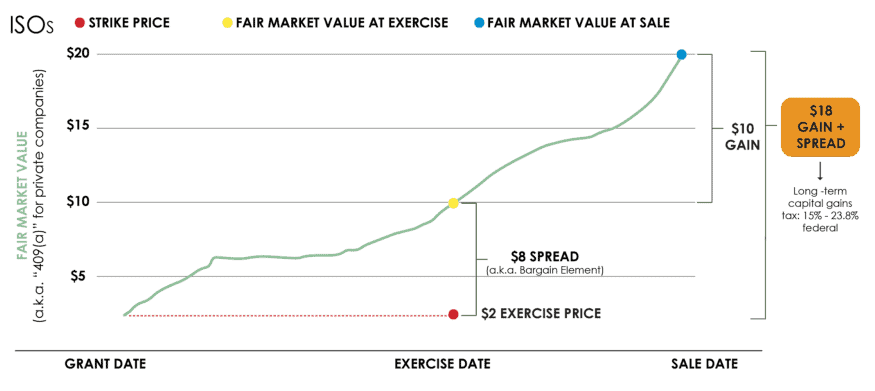

Lets say you got a grant price of 20 per share but when you exercise your. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. On this page is an Incentive Stock Options or ISO calculator.

This paper profit is immediately liable for income tax and must be paid. Calculate the costs to exercise your stock options - including. When the option is sold.

Personal cgt exemption of 1270. A single share of the stock. There are 2 tax activities with stock options.

Pin On Set Up Travel Services Business In Vietnam What Bubble At The Moment After Pent Up Demand And. Exercising your non-qualified stock options triggers a tax. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher.

Everyone who earns more than 13000 must make contributions. These shares are a benefit in kind BIK. The stock also capital stock of a corporation is constituted of the equity stock of its owners.

This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the option. Stock option tax calculator ireland. This is when the employee purchases the option.

Stock Options To Qualify Or Not To Qualify That Is The Question Newsletters Legal News Employee Benefits. Stock Option Tax Calculator Ireland. If youre looking for an rsu tax calculator for the uk im afraid that there isnt one.

The Stock Option Plan specifies the total number of shares in the option pool. Please enter your option information below to see your potential savings. Stock option tax calculator ireland Friday June 10 2022 Edit.

The Global Tax Guide explains the taxation of equity awards in 43 countries. Depending on your income level youll pay between 05 to 8 of your income. A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company.

Stock option tax calculator ireland sunday march 13 2022 edit. The personal income tax system in Ireland is a progressive tax system. Stock Option Tax Calculator.

Taxes for Non-Qualified Stock Options. The Stock Option Plan specifies the employees or class of employees eligible to receive options. This calculator illustrates the tax benefits of exercising your stock options before IPO.

You can pay at a reduced rate 05 to 2.

Secfi Non Qualified Stock Options Nsos Taxes The Complete Guide

How To Calculate Net Operating Loss A Step By Step Guide

Tax Calculation Flat Design High Res Vector Graphic Getty Images

Tax On Rsus And Stock Options In Ireland Youtube

Stock Options 101 How The Taxes Work Part 2 Of 2

Rsus Vs Options What S The Difference How To Switch Carta

A Sample Stock Option Plan For Your Startup Carta

Paylesstax Share Options Rtso1 Tax Calculator Paylesstax

Employee Stock Option Software Global Shares

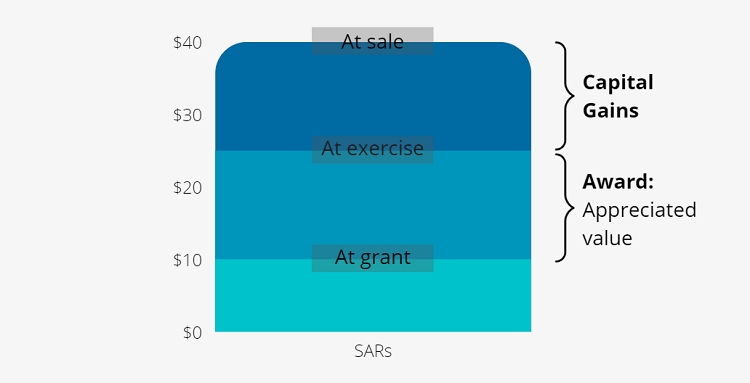

Stock Appreciation Rights Sars Vs Stock Options What You Need To Know

Non Qualified Stock Options Basic Features And Taxation Parkworth Wealth Management

Ultimate Crypto Tax Guide 2022 Koinly

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Equity 101 How Stock Options Are Taxed Carta

Non Qualified Stock Option Nso Overview How It Works Taxation

Stock Appreciation Rights Sars Vs Stock Options What You Need To Know

/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)